이미지 확대보기

이미지 확대보기On July 30, SK Innovation announced a surprise merger between its EV battery-making subsidiary SK on and SK Enmove, which operates the group’s lubricants business.

SK Enmove, regarded as a cash cow within the group, has generated nearly KRW 1 trillion in average annual operating profit over the past three years, providing a stable profit stream that can offset SK on’s substantial losses. While SK Enmove had previously explored an IPO, it will now remain as a steady cash generator until SK on is back on a solid footing.

SK on aims to cut its debt ratio from the current 251% to below 100% by 2030, while targeting EBITDA above KRW 10 trillion.

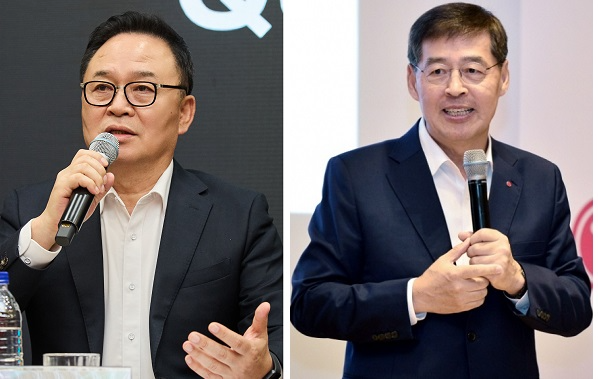

SK Innovation affiliates have also begun replacing their fleet with Hyundai and Genesis electric vehicles equipped with SK on batteries — a symbolic move reflecting commitment to the EV future. “We will focus on enhancing SK on’s fundamental competitiveness,” said Jang Yong-ho, Executive President of SK Innovation.

Like SK, LG Chem also places a high value on the future of its battery business. Even with a need for short-term funding, the company has chosen to sell a lucrative unit while retaining its core asset — its stake in LG Energy Solution.

Market expectations since last year had suggested that LG Chem might sell part of its stake in battery subsidiary LG Energy Solution (LGES) to raise cash. LG Chem currently owns 81.8% of LGES, and analysts projected it could sell 10–20% — a level that would not impair control — to ease its rising financial burden.

The unit generates roughly KRW 100 billion in annual sales and around KRW 30 billion in EBITDA, and is valued more for future growth than for current earnings. LG Chem had originally sought about KRW 500 billion, but ultimately accepted less than half that amount. While noting that the aesthetics market has significant growth potential, driven by rising demand for beauty and anti-ageing treatments, the company said the sale was a strategic choice to concentrate on strengthening its core businesses and new growth engines.

This is not LG Chem’s first disposal of non-core assets. In October 2023, it sold its in-vitro diagnostics device business for KRW 150 billion, followed by the sale of its display polarizer and materials unit for KRW 1 trillion in December 2024 and the advanced materials water solutions business for KRW 1.4 trillion in June 2025. Proceeds have been reinvested into battery materials and pharmaceuticals.

An industry insider said the decision reflects a bet on the rising value of equity holdings as the battery market expands, adding that it demonstrates confidence in the long-term outlook for the battery business.

Gwak Horyung (horr@fntimes.com)

[관련기사]

- SK On’s U.S. Battery Plant Hits Full Operation After 3 Years — A Turning Point Toward Profitability?

- LG Chem’s Shin Hak-cheol Issues KRW 1.4T in Exchangeable Bonds Alongside Push to Sell Non-Core Assets

- SK On Turns to Private Bonds Amid Market Challenges—Can It Stabilize Its Finances?

- Why Is LG Left Behind While Holding Companies Soar?

- LG Energy Solution, Samsung SDI and SK-on Aim for 'K-Battery Comeback'

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Samsung Electronics and SK Hynix Engage in High-Stakes AI Chip War [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026013013432407964141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

!["Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011408580109459141825007d12411124362.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)