Naver (CEO Choi Soo-yeon) has entered the era of annual revenue of KRW 10 trillion. It is the first domestic internet platform company to do so.

Some assess that Naver has transformed from a premium growth stock into an ordinary stable company.

According to Korea Ratings and NICE Credit Rating, Naver's credit rating has consistently maintained 'AA+ (stable)' since 2019.

Over the past six years, Naver's revenue has steadily grown. Particularly from 2020 to 2022, as new businesses including search platforms, commerce, fintech, content, and cloud grew rapidly, revenue recorded double-digit growth rates annually. Through 2021, operating profit and operating profit margin improved along with revenue expansion.

However, in 2022, despite revenue increasing by approximately 20% year-over-year, operating profit slightly declined (-1.6%), causing margins to contract. This is interpreted as profits from core operations failing to keep pace with revenue growth, as investments, M&A (mergers and acquisitions), and various one-time factors were all reflected simultaneously that year.

Massive M&A and investments weigh on profitability

In October 2022, Naver announced the acquisition of North American C2C (consumer-to-consumer) platform 'Poshmark,' completing the transaction in early the following year for approximately KRW 1.9 trillion. The Poshmark acquisition was the largest M&A since Naver's establishment.The problem is that profits have not sufficiently kept pace with this investment expansion. Indicators showing how much the company earned relative to its asset holdings have noticeably weakened since 2022.

이미지 확대보기

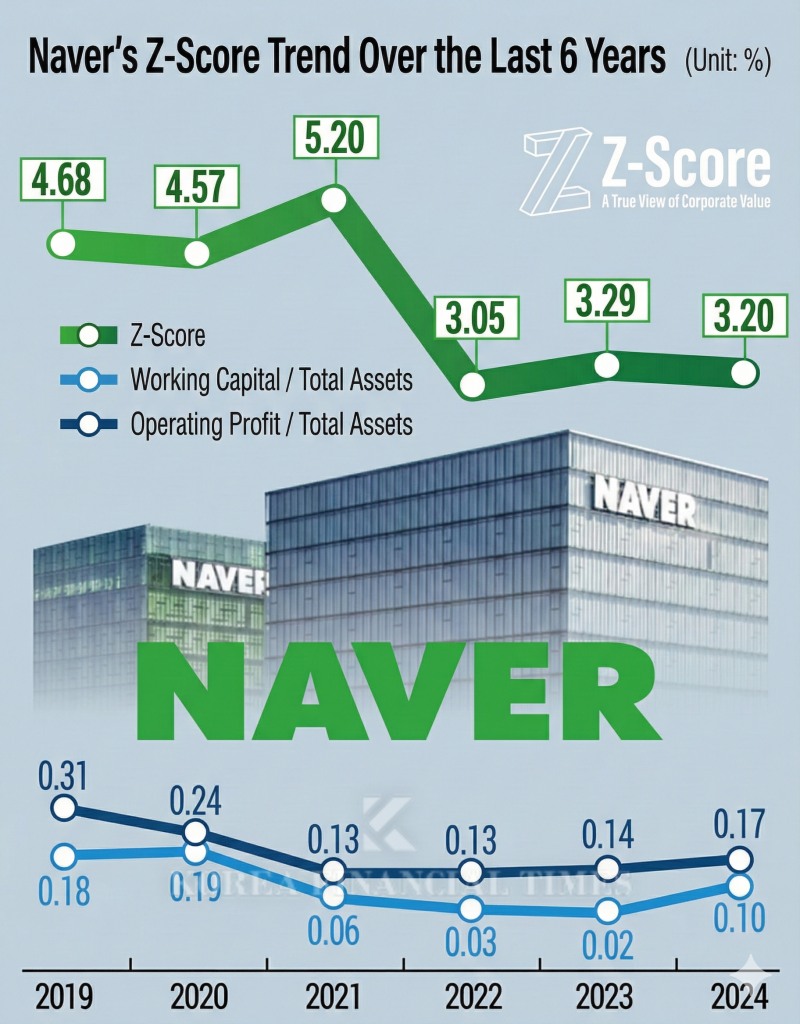

이미지 확대보기For instance, the 'operating profit/total assets' indicator fell from 0.31 in 2019 to 0.13 in 2022. During the same period, the 'revenue/total assets' indicator also declined from 0.35 to 0.24.

This signifies not merely a temporary cost increase, but that return on investment and asset allocation efficiency have deteriorated compared to the past. There are observations that it's not unusual for the market to assign only average valuations instead of growth stock premiums to a company that generates less profit despite deploying the same assets.

Additionally, the Line-Z Holdings integration process left additional optical illusions in Naver's income statement during 2021-2022. A base effect occurred where net profit appeared to plummet in 2022 after the one-time gain disappeared, which had temporarily increased significantly on the books during the 2021 process of revaluing Line shares.

However, even accounting for such accounting volatility, there are observations that Naver's financial constitution itself is difficult to view as being as solid as before.

Altman Z-Score reveals weakened financial strength

Naver's Altman Z-Score, confirmed by Korea Financial Times through the AI data platform DeepSearch, was calculated as ▲4.68 in 2019 ▲4.57 in 2020 ▲5.20 in 2021 ▲3.05 in 2022 ▲3.29 in 2023 ▲3.20 in 2024.After plummeting more than 1 point from the 5-point range in 2021 to the 3-point range in 2022, it has since struggled to recover from the early 3-point range. While not in the distress risk zone, this is the background for interpretations that the safety and growth premiums once evaluated as ultra-premium have been substantially diluted.

Working capital relative to total assets also declined from 0.18 in 2019 to 0.10 last year. Analysis suggests that as market capitalization—one of the components of the Altman Z-Score—significantly decreased, the market's perception of Naver's 'stability premium' has also faded.

Naver's market capitalization grew from KRW 30.7377 trillion in 2019 to KRW 62.0926 trillion in 2021, but plunged to KRW 29.1187 trillion in 2022 and currently hovers around KRW 40 trillion.

Since 2023, Naver's numbers have clearly been recovering. Both operating profit and operating profit margin escaped the 2022 bottom and showed an upward trend again, with last year recording all-time highs in both revenue and profit.

Nevertheless, the market's perception differs from 2021. There are assessments that compared to the size already committed to trillions in AI and cloud infrastructure and large-scale M&A, the profit growth rate is insufficient to again merit the label 'ultra-premium.'

The fact that the previously examined revenue and profit indicators relative to assets and Z-Score have not recovered to 2021 peak levels supports this view.

Google utilized generative AI 'Gemini' as a core means to strengthen search service competitiveness. In contrast, there are observations that Naver's AI investments remained at a level of broadly reinforcing each business division rather than making a clear decisive move centered on its portal.

In this process, there are criticisms that by expanding business into relatively unfamiliar areas such as content and shopping, the company failed to sufficiently boost return on investment.

The recent merger between Naver Financial and Dunamu raises similar concerns. Industry observers expect that partnering with the virtual asset exchange industry leader could enable construction of a massive financial platform encompassing payments, investments, and digital assets.

On the other hand, there are considerable concerns that considering regulatory uncertainty in the virtual asset market, price volatility, and high capital requirements, this adds another capital-intensive burden to Naver, which is already conducting large-scale investments in AI, cloud, content, and commerce. An industry insider stated, "Whether the merger with Dunamu will be a growth card that revives the premium or a risk that further solidifies the 'stable' label remains a question mark."

Ultimately, the key to whether Naver can regain the 'ultra-premium' label lies not in simple revenue growth. The essence is how much stable cash flow and high margins can be generated from the already deployed AI and cloud, global content, and fintech-digital asset businesses.

Simultaneously, work is needed to restore market trust by reducing concerns about platform regulations, data monopoly, and virtual asset risks. An industry insider stated, "When the company proves not only growth potential but also predictable governance structure and risk management capabilities, the premium attached to 'premium growth stocks' will again become Naver's."

Jeong Chaeyun (chaeyun@fntimes.com)

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Hanwha Aerospace Stock Surges 3,500% in Six Years on 'Extraordinary Strength' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012609443900770141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)