이미지 확대보기

이미지 확대보기◇ Samsung Biologics Surpasses KRW 1 Trillion in Cash Assets

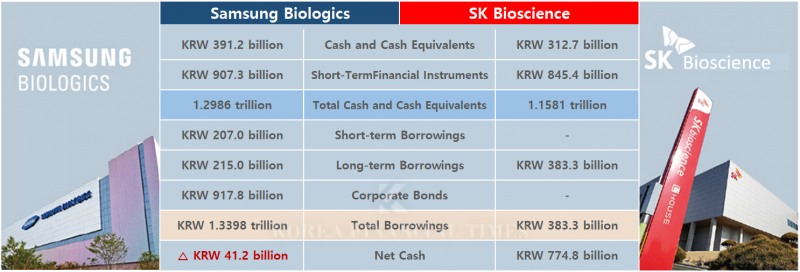

According to a Financial Supervisory Service disclosure on May 6, 2025, Samsung Biologics held KRW 1.2986 trillion in total cash and cash equivalents at the end of last year, comprising KRW 391.2 billion in cash and cash equivalents and KRW 907.3 billion in short-term financial instruments.Despite a smaller cash reserve, investment appetite increased. The company spent KRW 2.0012 trillion on facility investments, including CDMO plants, a 155.8% increase from KRW 782.2 billion in 2023.

Last month, Samsung Biologics began full-scale operations of its 180,000-liter Plant 5, raising total production capacity to 784,000 liters-the largest globally. The company plans to invest a total of KRW 7.5 trillion by 2032 to build its second Bio Campus (Plants 5–8), expanding capacity to 1.324 million liters. Internal discussions are also underway to establish dedicated production facilities for new modalities such as antibody-drug conjugates (ADC).

Strong cash flow underpins this investment drive. Samsung Biologics generated KRW 1.9604 trillion in cash from operating activities in 2024. While borrowings and bonds totaled KRW 1.3398 trillion, resulting in net debt of KRW 41.2 billion, operating cash flow comfortably covers liabilities.

This contrasts sharply with the domestic biotech sector’s funding squeeze. Venture capital data from The VC shows that investment deals in Korea’s bio, medical, and healthcare sectors dropped from 522 in 2021 to 225 last year, with investment amounts shrinking from KRW 3.7358 trillion to KRW 1.0934 trillion.

An industry insider commented, “Unlike other biotech firms, Samsung Biologics has a stable revenue base and cash flow. It is one of the rare companies that can withstand increased depreciation expenses from expanded facility investments such as Plant 5.”

◇ SK Bioscience Tops in Net Cash, Ready for M&A Expansion

SK Bioscience also boasts a strong cash position, with KRW 1.1581 trillion in cash and cash equivalents last year, up 11.1% from KRW 1.2741 trillion at the end of 2023.Notably, SK Bioscience’s net cash position is KRW 774.8 billion after deducting total borrowings of KRW 383.3 billion.

While Samsung Biologics leads in cash assets among KOSPI-listed biotech firms, SK Bioscience ranks first in net cash. The company accumulated substantial cash during the COVID-19 pandemic, generating billions in operating profit centered on its vaccine business. It also raised KRW 1.5 trillion through an initial public offering (IPO) in 2021.

With ample financial resources, SK Bioscience is actively pursuing business diversification and future growth through mergers and acquisitions (M&A).

SK Bioscience acquired the German CDMO company IDT Biologika for KRW 356.4 billion in June last year. In October, it purchased a controlling stake in U.S. biotech company PinA BioSolutions for KRW 4.1 billion. The company is also moving quickly to secure next-generation technologies, including a conditional acquisition of U.S.-based Sunflower’s shares.

SK Bioscience plans to continue investing in promising global biotech companies.

A company spokesperson stated, “We will secure competitiveness through investments and M&A in promising companies with excellent technologies, laying the foundation for a full-scale leap as a global company.”

Kim Nayoung, Korea Finacial Times (steaming@fntimes.com)

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Robot Joints, 80%-a-Year Growth: Hyundai Mobis, Samsung Electro-Mechanics Lead Korea's Actuator Rush [K-Humanoid Wars ④]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030908365902517141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)