이미지 확대보기

이미지 확대보기According to the financial industry on the 19th, Woori Financial Group will announce the appointment of subsidiaries' presidents as early as the 20th.

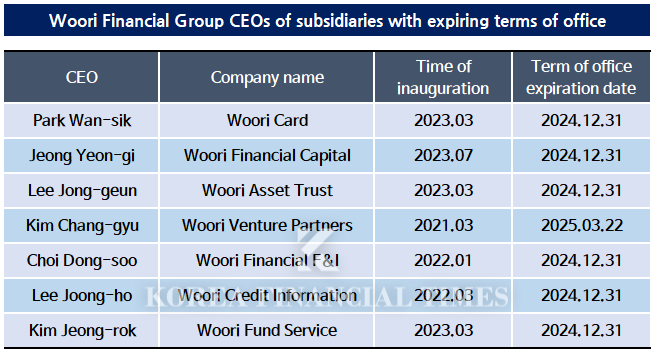

Park Wan-sik, Lee Jong-geun, and Kim Jeong-rok all took office in March of last year, and Jeong Yeon-gi assumed the position of CEO in July of last year when then-Woori Financial Capital CEO Cho Byeong-gyu was appointed as the Woori Bank president.

In the banking industry, it is expected that the subsidiaries’ presidents will also be largely replaced, as Chairman Lim Jong-ryong has clearly shown his will to reorganize personnel through the appointment of candidate Jeong Jin-wan. Candidate Jeong Jin-wan of Woori Bank was recommended as a candidate for president just one year after being appointed as vice president, and is also the youngest of the four major bank president candidates, born in 1968.

A financial industry insider said, “There have been continuous criticisms that he is a ‘parachute appointment’ lacking expertise in the relevant industry,” and “It is true that he is not shining in his respective industries despite being affiliated with one of the four major banks.”

Financial Supervisory Service Governor Lee Bok-hyun also strongly criticized the Woori Bank unfair loan scandal in early September, saying, “I suspect that there is no will to reform in an organization where a culture of sharing and cliques is prevalent.”

Despite the good performance of Card, Capital, F&I, and Funds... 'Reappointment will be difficult'

Park Wan-sik, CEO of Woori Card, is a person whose capabilities have been recognized, having been named along with President Cho on the Woori Bank President selection longlist last year.Since taking office as CEO of Woori Card, his performance has also been good, with cumulative net profit for the third quarter of this year reaching KRW 140 billion, up 19.7% year-on-year.

It is analyzed that the strategy of increasing the number of independent franchises and reorganizing the portfolio centered on financial assets led to improved performance.

Woori Financial Capital’s cumulative net profit also increased 6.02% year-on-year to KRW 115.7 billion in the third quarter of this year.

This is due to the positive effects of the increase in auto finance assets centered on auto leases and rentals and the base effect of preemptive bad debt reserves.

However, despite these achievements, the industry is focusing on the possibility that CEOs Park Wan-sik and Jeon Young-ki will not be reappointed.

Although their performance has improved, they have not yet stood out among the card and capital companies affiliated with commercial banks. Based on the accumulated net profit in the third quarter of this year, the two companies are both ranked last among the four major bank-affiliated card and capital companies.

The fact that the Financial Supervisory Service has found suspicions in Woori Card and Woori Financial Capital related to the unfair lending incident is also expected to have a negative effect on their reappointment.

In particular, Woori Financial Capital recently received a 'management caution' notice for internal control deficiencies. The Financial Supervisory Service (FSS) has assessed that the post-monitoring of loan fund usage is 'significantly insufficient.

Jeong Yeon-gi, CEO of Woori Financial Capital, is classified as a member of Chairman Lim Jong-ryong's so-called 'Yonsei University line', so if he is reappointed, he could once again be embroiled in an academic controversy.

Currently, it is reported that former Lotte Card advisor Jin Seong-won is the most likely candidate among the three final candidates for the new CEO of Woori Card.

Initially, there were evaluations that Woori Bank Vice President Kim Beom-seok would have an advantage in terms of name recognition and convention, but industry insiders explain that the atmosphere has changed even more since the recommendation of President Jeong Jin-wan.

CEO Choi Dong-soo also increased the net profit of Woori Financial F&I from KRW 900 million at the time of its establishment in 2022 to KRW 11.8 billion as of the third quarter of this year, and CEO Kim Jeong-rok of Woori Fund Service also increased net profit by 20% during the same period, but the outlook for reappointment is not optimistic.

A financial industry insider said, “All six people whose terms are about to expire are from Woori Holdings and banks, and considering the authorities and public opinion, the reappointment of these representatives could be a risk in itself,” adding, “Even if they appoint internal employees again, discussions will be held in the direction of replacing the current CEO.”

Asset trust and credit information, possibility of replacement due to decline in net profit↑

In a situation where even a CEO who succeeded in improving performance is replaced, it is difficult to think about the possibility of a CEO who has suffered negative growth being reappointed.Lee Jong-geun, the CEO of Woori Asset Trust, was hit hard by the deterioration of the real estate market. Net profit fell from KRW 53 billion in the third quarter of last year to KRW 17.4 billion in the third quarter of this year, which is one-third of the previous year. The annual net profit for 2023 was KRW 32.3 billion, half of the KRW 60.3 billion recorded in 2022.

Lee Joong-ho, the CEO of Woori Credit Information, who was successfully reappointed in March of this year, also failed to maintain performance. As of the third quarter of this year, Woori Credit Information’s net profit was KRW 1.7 billion, which is less than half of the KRW 3.6 billion in the third quarter of the previous year.

The industry is speculating that the new head will be a “shake-up” or an “outsider” like Chung.

A banking industry insider said, “Although 11 vice presidents have been replaced due to Chung's high-intensity reshuffle, if he sends them back to become subsidiary presidents, he will not be able to avoid criticism for ‘turning back the clock’ instead of 'renewal.

Among the executives of the holding company, there are currently nine people who can move to the position of CEO of a subsidiary, including eight vice presidents and one managing director. These include Vice President Ok Il-jin of the Digital Innovation Division, who was promoted at the end of last year, Managing Director Lee Hae-kwang of the Management Support Division, Vice President Lee Seong-wook of the Finance Division, whose terms are set to expire early next year, and Vice President Park Jang-geun of the Risk Management Division, Vice President Lee Jeong-soo of the Strategy Division. Of these, Vice President Lee Seong-wook and Managing Director Lee Hae-kwang are members of Chairman Lim Jong-ryong's 'Yonsei University line' along with CEO Jeong Yeon-gi, so it seems virtually impossible to recommend them as candidates.

"Most holding company executives are people whose abilities are recognized, but in the current situation, 'expertise in the industry' is needed to appoint them as representatives of subsidiaries," is the industry's analysis.

Kim Seonghoon, Korea Finacial Times (voicer@fntimes.com)

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![[인터뷰] 소재권 서울 중구의장 “주민 체감할 수 있는 생활 정치에 초점”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2024121118185807153b372994c95491668316.jpg&nmt=18)

![“내년 한국 경제성장률 2.0%…확장적 통화정책으로 내수 활성화 필요” [금융연구원 2025 전망]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2024111123015701520f09e13944d582914364.jpg&nmt=18)

![김병환 "가계대출 총량 안정화 노력"…임종룡 "부당대출 책임질 것" (종합) [2024 국감]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2024101100541400876f09e13944d391241172.jpg&nmt=18)

![내달 3일 경제·금융 수장 한자리에 모인다…‘2025년 범금융 신년인사회’ 개최 [2025 범금융 인사회]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2024010316011104222f09e13944d2112341925.jpg&nmt=18)

![강남구 ‘현대힐스테이트2단지’ 18평, 2.42억원 오른 16.32억원에 거래 [일일 아파트 신고가]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2023110915385506755b372994c951245313551.jpg&nmt=18)