이미지 확대보기

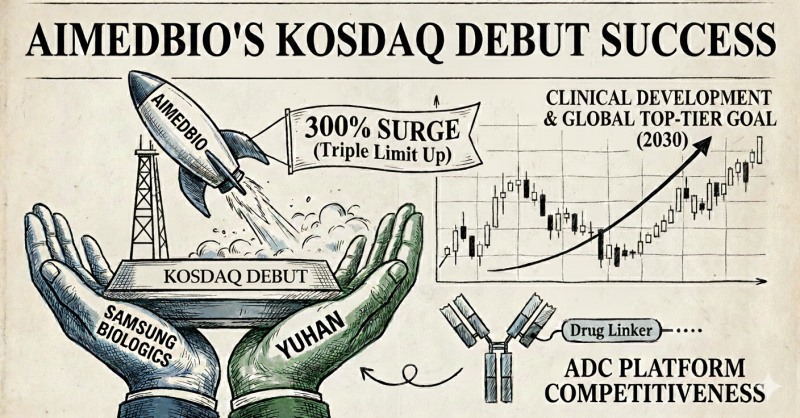

이미지 확대보기According to the industry on December 8, AIMEDBIO entered the KOSDAQ market on December 4. The company closed its first trading day at the upper price limit of KRW 44,000, up 300% from the offering price of KRW 11,000. On December 5, the second trading day, it also jumped to the price limit, closing at KRW 57,200, up 30% from the previous day.

The company was established in 2018 by Professor Nam Do-hyun, an expert in brain diseases who researched brain tumors as a neurosurgeon at Samsung Medical Center, as a spin-off from Samsung Medical Center.

AIMEDBIO develops antibody-drug conjugate (ADC) candidates through its 'P-ADC platform.' This platform can consistently perform from target discovery to antibody development, linker-payload optimization, and preclinical validation.

Samsung Life Science Fund (SVIC 54 and 63), jointly invested by Samsung C&T, Samsung Biologics, and Samsung Bioepis, participated as a strategic investor (SI) in AIMEDBIO. SVIC 54 was invested by Samsung C&T and Samsung Biologics, while 63 was invested by Samsung Bioepis. This is the first case of Samsung Life Science Fund investing in a domestic company.

As of the end of last year, SVIC 54 held KRW 3.5 billion in Redeemable Convertible Preferred Stock (RCPS) and KRW 1.8 billion in Convertible Preferred Stock (CPS). Fund 63 also holds RCPS (KRW 0.8 billion) and CPS (KRW 0.4 billion).

Samsung Biologics, along with equity investment, conducts joint research on ADC toolbox development with AIMEDBIO. The company plans to collaborate in various areas, including performing Contract Development Organization (CDO) tasks for monoclonal antibody-based atopic dermatitis and dementia treatments (AMB001).

Before listing, AIMEDBIO succeeded in technology transfer of preclinical-stage ADC candidates developed through the P-ADC platform. The company transferred technology for FGFR3 (Fibroblast Growth Factor Receptor 3) targeted therapeutic 'AMB302' to U.S.-based Biohaven in December last year.

In January this year, it signed a technology transfer option contract with SK Plasma for 'AMB030,' a candidate for refractory cancer treatment. Subsequently, in October, it successfully contracted to transfer ADC candidates to Germany's Boehringer Ingelheim for KRW 1.4 trillion, achieving total technology transfer results exceeding KRW 3 trillion in the pre-listing stage alone. Based on technology transfer contract results, it successfully turned to operating profit in the second half of last year and continued operating profit in the first half of this year.

Huh Nam-gu, CEO of AIMEDBIO, said, "With listing as an opportunity, we will break away from a technology transfer-centered structure and expand into a biotech with clinical development capabilities," adding, "Our goal is to leap forward as a global top-tier ADC company by 2030."

Yang Hyunwoo (yhw@fntimes.com)

[관련기사]

- ABL Bio Positioned as Next KOSDAQ Biotech Leader on Platform Technology Strength

- "Sales Up, Profits Down": Which Drugmakers Are Failing to Cash In?

- Hanmi Pharm pursues performance rebound through technology transfer and indication expansion

- CJ Bio Shifts Survival Strategy : 'From New Drug-Only Focus to Diversified Revenue Streams'

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Robot Joints, 80%-a-Year Growth: Hyundai Mobis, Samsung Electro-Mechanics Lead Korea's Actuator Rush [K-Humanoid Wars ④]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030908365902517141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)