이미지 확대보기

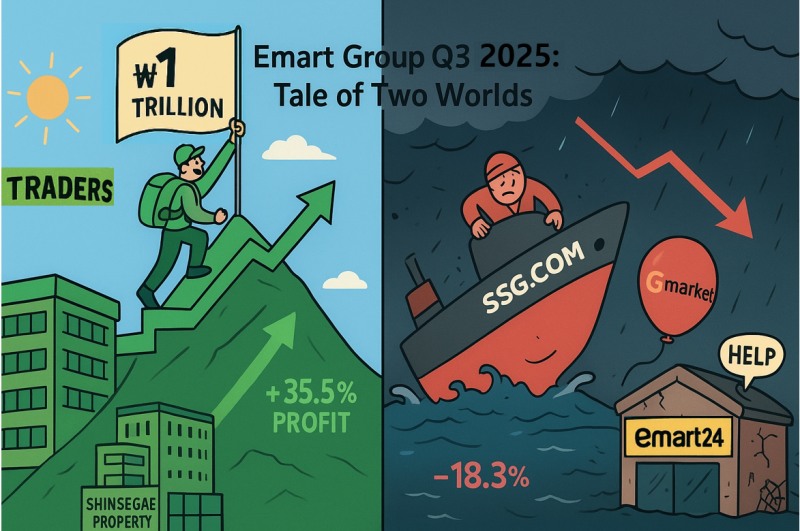

이미지 확대보기According to the Financial Supervisory Service's electronic disclosure system on November 11, Emart's consolidated revenue decreased 1.4% year-over-year to KRW 7.4008 trillion. However, with operating profit increasing, the company continued its earnings improvement trend following its return to profitability in Q2. Cumulative operating profit for the first three quarters reached KRW 332.4 billion, up 167.6% from KRW 124.2 billion in the same period of 2024.

By business division, discount stores (Emart) recorded total sales of KRW 2.9707 trillion in Q3 2025, down 3.4% year-over-year, with operating profit decreasing 21% to KRW 54.8 billion.

Traders broke through the milestone of KRW 1 trillion in quarterly total sales for the first time. Q3 total sales increased 3.6% year-over-year to KRW 1.0004 trillion, and operating profit rose 11.6% to KRW 39.5 billion. Traders has established itself as a core growth pillar driving Emart's profitability improvement with its steady growth momentum.

Notably, the Magok store (opened in February) and Guwol store (opened in September), both opened this year, achieved profitability from their first month and settled in successfully. This strengthened Traders' competitiveness along with external growth.

An Emart official commented, "The strategy centered on the private brand 'T Standard,' which combines differentiated products focused on bulk buying and value for money with global sourcing capabilities, led to enhanced core competitiveness and became Traders' distinctive strength even amid high inflation." In fact, T Standard's Q3 sales increased 25% compared to the same period last year.

Specialty stores (No Brand) recorded total sales of KRW 254.8 billion, down 2.9% year-over-year, with operating profit decreasing 25% to KRW 8.3 billion. SSM business Everyday's total sales decreased 0.6% year-over-year to KRW 367.8 billion, while operating profit increased 62% to KRW 10.2 billion.

SSG.com's net sales decreased 18.3% year-over-year to KRW 318.9 billion, with operating losses expanding by KRW 25.7 billion to KRW 42.2 billion. Gmarket also saw net sales decrease 17.1% year-over-year to KRW 187.1 billion, with operating losses expanding by KRW 6.4 billion to KRW 24.4 billion.

Emart24 recorded sales of KRW 552.1 billion, down 2.8% year-over-year, with operating losses expanding by KRW 7.7 billion to KRW 7.8 billion.

In contrast, Shinsegae Property, Shinsegae Food, and Chosun Hotel & Resort posted stable results. Shinsegae Property's net sales increased 46.8% year-over-year to KRW 114.6 billion, with operating profit rising by KRW 34.8 billion to KRW 39.5 billion. An Emart official explained, "We achieved solid results thanks to strong business performance centered on Starfield, which customers consistently visit, and participation in various development projects."

Shinsegae Food's net sales increased 1.4% year-over-year to KRW 390.8 billion, with operating profit rising by KRW 1.5 billion to KRW 10 billion. Chosun Hotel & Resort's revenue increased 12.7% to KRW 210.8 billion, with operating profit rising by KRW 2.6 billion to KRW 22 billion. The company showed stable growth momentum as operating profit expanded through improved occupancy rates and average room rates.

An Emart official stated, "Q3 results demonstrate that our core business competitiveness is strengthening without being shaken by external variables. We will continue our stable growth trajectory based on core business competitiveness while strengthening benefits that customers can feel, centered on the three pillars of price, products, and space."

Park seulgi (seulgi@fntimes.com)

[관련기사]

- Despite KRW 950 Billion Net Loss, Emart Expands Dividends…PBR at 0.24x ‘Attractive’

- Chung Yong-jin’s “Determined Resolve” Proven by Results… E-commerce Still Has a Long Way to Go

- On the Same Boat with Alibaba? Shinsegae Still Has a Long Way to Go

- Distribution CEO's Key Message for 2025... Shin Dong-bin's 'Constitution Improvement', Chung Yong-jin's 'Main Business', Chung Ji-seon's 'Cooperation'

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![용산구 ‘나인원한남’ 88평, 9억 상승한 167억원에 거래 [일일 아파트 신고가]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025071010042800278b372994c952115218260.jpg&nmt=18)