이미지 확대보기

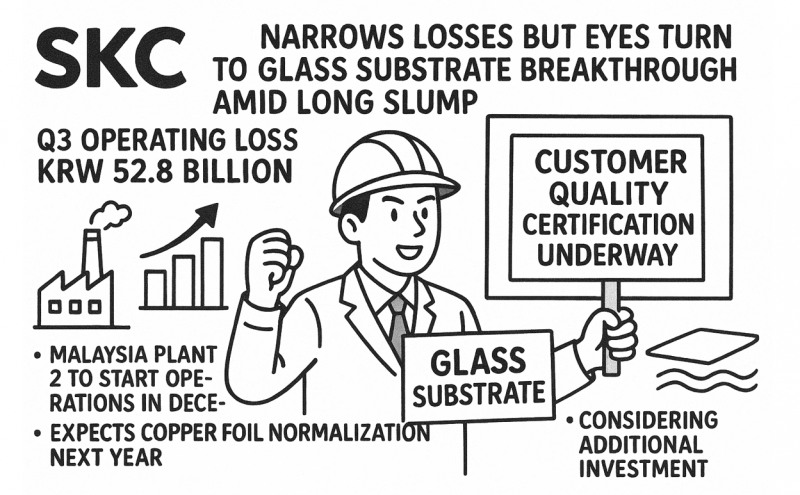

이미지 확대보기On the 5th, SKC provisionally announced that it recorded sales of KRW 506.0 billion, operating loss of KRW 52.8 billion, and net loss of KRW 99.0 billion in Q3 this year. Sales increased 8.3% and operating loss scale decreased 11.4% compared to Q2. However, net loss increased by KRW 95.0 billion.

The company expects the secondary battery materials business to normalize around the second half of next year. With growing North American ESS (Energy Storage System) demand, SK nexilis' Malaysia Plant 2 will begin operations in December this year. The company explains that profitability improvement will also accelerate when the plant reaches "full operation." Yoo Ji-han, SKC's CFO, stated, "The current Malaysia Plant 1 operation rate is around 40%," adding, "Expectations for cost structure improvement have risen significantly as we achieved break-even point (BEP) in September."

Beyond its secondary battery materials business, the area drawing even greater investor attention is the semiconductor material “glass substrate” business. Glass substrate is considered an innovative technology that will change the existing silicon-based semiconductor packaging landscape. SKC has declared through its U.S. subsidiary Absolics that it will commercialize glass substrate in 2026 as the world's first.

Driven by such expectations, SKC's stock price is trading in the KRW 120,000 range despite today's decline. This is a 19% surge in just two weeks from KRW 105,200 on the 23rd of last month.

CFO Yoo stated, "We produced the first mass production samples this quarter at the glass substrate mass production line in Georgia, U.S., and started the customer certification process," adding, "The submitted samples are showing very positive simulation evaluation results." He added, "We are also reviewing various investment support measures at the headquarters level to accelerate the business."

Gwak Horyung (horr@fntimes.com)

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![용산구 ‘나인원한남’ 88평, 9억 상승한 167억원에 거래 [일일 아파트 신고가]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025071010042800278b372994c952115218260.jpg&nmt=18)

![이름은 ‘한강버스’, 아직은 ‘지각버스’…관광용으로는 딱 좋네 [르포]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025110416204007309b372994c951245313551.jpg&nmt=18)

![이필형 동대문구청장, 동대문교육협력특화지구 업무협약 [우리 구청장은 ~~]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025102623463907044dd55077bc25812315216.jpg&nmt=18)

![김미경 은평구청장, 가을밤 숲속 음악회 참석 [우리 구청장은 ~~]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025102623454007832dd55077bc25812315216.jpg&nmt=18)

![이성헌 서대문구청장, 순국선열정신 선양대회 참석 [우리 구청장은 ~~]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025102623443705780dd55077bc25812315216.jpg&nmt=18)

![이름은 ‘한강버스’, 아직은 ‘지각버스’…관광용으로는 딱 좋네 [르포]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2025110416204007309b372994c951245313551.jpg&nmt=18)