이미지 확대보기

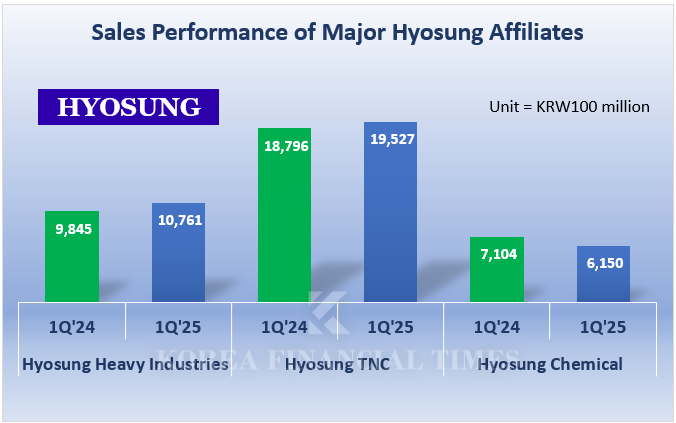

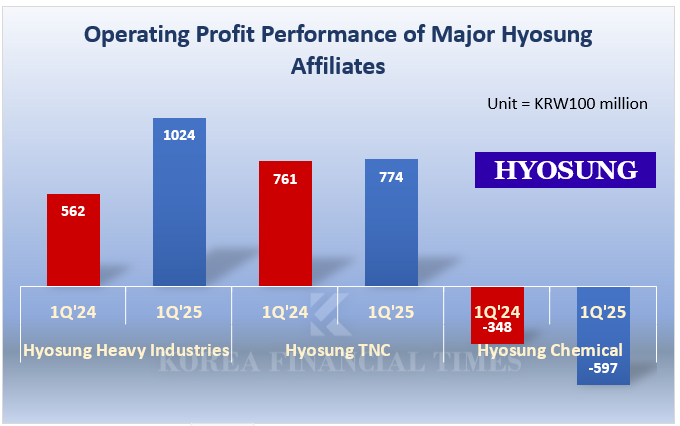

이미지 확대보기Hyosung Heavy Industries recorded sales of KRW 1.0761 trillion and operating profit of KRW 102.4 billion (operating margin 9.5%) in the first quarter of this year. Compared to the first quarter of last year, sales increased by 9.3% and operating profit surged by 82.2%.

Specifically, the heavy industries division posted its highest-ever first-quarter performance, with sales of KRW 730.8 billion and operating profit of KRW 90.1 billion. The operating margin reached 12.3%, nearly double that of the first quarter of last year (6.2%). The company achieved an operating margin that exceeded the 10.8% posted in the seasonally strong fourth quarter of last year. Last quarter, the expansion of orders for ultra-high voltage power equipment in Europe, the United States, and the Middle East led to new orders totaling KRW 2.0085 trillion, marking a record for the first quarter.

The construction division recorded sales of KRW 344.2 billion and operating profit of KRW 12.1 billion (operating margin 3.5%). Compared to the same period last year, both figures decreased by 14% and 40%, respectively, continuing the downturn.

Although overshadowed by Hyosung Heavy Industries, Hyosung TNC also delivered better-than-expected results in the first quarter. Sales reached KRW 1.9527 trillion, with operating profit of KRW 77.4 billion (operating margin 4.0%). While similar to the first quarter of last year, operating profit exceeded the consensus (KRW 65 billion) by about 20%, marking a surprise. The company explained, “The spread (the margin between raw material and selling prices) improved due to enhanced cost competitiveness in the fiber division, including spandex, nylon, and polyester.” Despite difficult market conditions, the company achieved solid results through increased production capacity, restructuring, and operational efficiency.

However, Hyosung TNC urgently needs a market rebound to ease its financial burden. In January, Hyosung TNC acquired the specialty gas business unit of Hyosung Chemical for about KRW 920 billion and established its subsidiary, Hyosung Neochem. As a result of financing for this acquisition, Hyosung TNC’s borrowings increased by 49%, from KRW 1.2966 trillion at the end of December last year to KRW 2.1938 trillion at the end of the third quarter this year. The net borrowings-to-equity ratio also jumped by 49 percentage points, from 65% to 115%.

Hyosung Chemical escaped a state of complete capital impairment by selling its specialty gas business unit. Nevertheless, weak performance continues. In the first quarter, it recorded sales of KRW 615 billion and an operating loss of KRW 59.7 billion. The operating margin worsened from minus 4.9% in the first quarter last year to minus 9.7% this year.

Gwak Horyung (horr@fntimes.com)

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Hanwha Aerospace Stock Surges 3,500% in Six Years on 'Extraordinary Strength' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012609443900770141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)