◇ Restructuring into 'Elder Son - Core Subsidiary, Younger Son - Holding Company' Model

According to industry sources on the 27th, Cosmax Group appointed Lee Byung-man, formerly CEO of Cosmax BTI, as CEO of Cosmax through its regular shareholders' meeting last month.Meanwhile, younger brother Lee Byung-joo has stepped down from his CEO position at Cosmax and will now serve solely as CEO of Cosmax BTI.

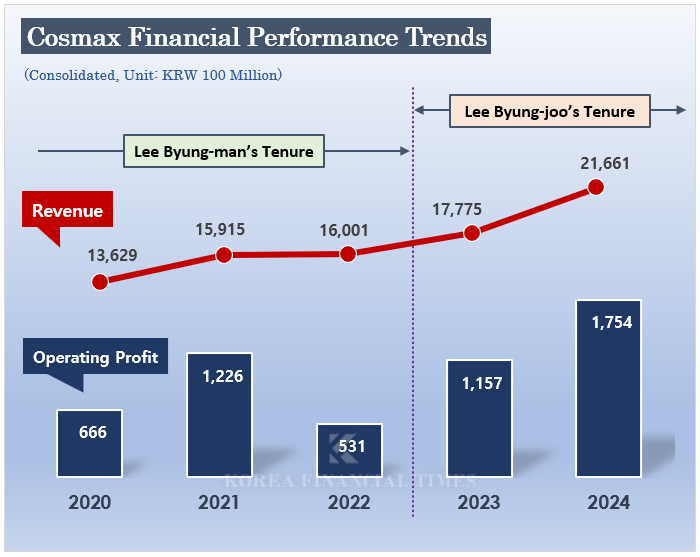

Lee Byung-joo has been in charge of Cosmax USA since 2014, holding positions such as Chief Financial Officer (CFO) and Chief Operating Officer (COO). In 2023, he was appointed CEO of Cosmax, achieving a record annual sales figure of KRW 2 trillion.

◇ 8 Years of Successor Competition, A Tug of War

With the latest restructuring, the succession race that has continued over the past eight years appears to favor the elder son. As Lee Byung-man now leads the group's core subsidiary, real management authority lies with the elder brother, while the younger manages the holding company.Lee Byung-man initially secured Cosmax’s management rights ahead of his younger brother in 2020, but handed over the reins to Lee Byung-joo in 2023, only to reclaim leadership after two years.

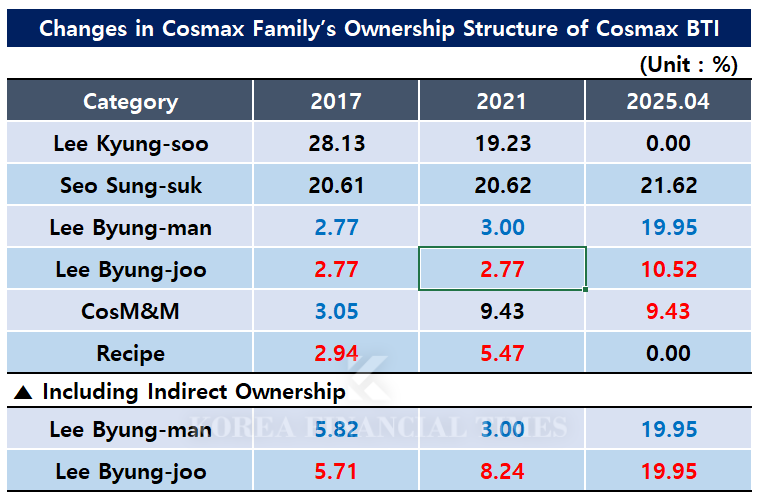

The succession battle traces back to 2017. At that time, Chairman Lee Kyung-soo began transferring his 34.02% stake in Cosmax BTI, selling 10.95% to the operating companies CosM&M and Recipe.

Since 2020, second-generation management officially began, and the leadership contest fluctuated. Initially, the younger brother held the advantage. Chairman Lee Kyung-soo resigned from the holding company's CEO position in 2020, appointing Lee Byung-joo as his successor. In 2021, the chairman acquired CosM&M entirely, reducing Lee Byung-man's effective stake to 3.00%.

However, in 2023, the succession structure shifted again. Chairman Lee Kyung-soo donated an 11.43% stake in Cosmax BTI to Lee Byung-man over two installments in March and April.

Additionally, Lee Byung-man acquired a 5.47% stake in Cosmax BTI held by Recipe, expanding his control to 19.95%. Meanwhile, Lee Byung-joo increased his stake to 10.52% by purchasing 5.83% and receiving a 1.92% stake through donation from the chairman.

Furthermore, at the end of 2023, Lee Byung-joo became the sole owner (100% stake) of CosM&M, which holds a 9.43% stake in Cosmax BTI.

Originally, CosM&M was controlled by the elder son, but Chairman Lee Kyung-soo had acquired 100% ownership in 2021 before transferring it to the younger son. Meanwhile, Recipe, which was originally under Lee Byung-joo, faced chronic deficits and remains under the chairman’s ownership after the 2021 acquisition.

Considering only direct ownership, Lee Byung-man leads. However, factoring in indirect holdings through CosM&M, both brothers effectively control an identical 19.95% of Cosmax BTI.

The year 2023 also marked a turning point in governance: all professional CEOs stepped down, signaling the end of the apprenticeship phase and the beginning of genuine sibling-driven management.

◇ The Remaining Factor is Mother's Stake, Round 3 of the Succession Battle

Two years later, prevailing opinion within the industry is that Chairman Lee Kyung-soo has awarded a higher evaluation to his elder son. The elder brother has overseen Asia, including China, while the younger has focused on the U.S. market.Under Lee Byung-man’s leadership, even during the COVID-19 pandemic, Cosmax managed to enhance its global presence in China and other Asian markets, maintaining stable performance.

In contrast, the U.S. subsidiary has continued to report losses since its establishment, recording an accumulated net loss of KRW 265 billion since a KRW 4.1 billion loss in 2014. Despite the 2017 acquisition of U.S. color cosmetics manufacturer NuWorld under Lee Byung-joo’s leadership, losses only deepened. Cosmax USA posted a net loss of KRW 32.2 billion last year alone.

The remaining key to the succession is the stake held by Seo Sung-suk, the chairwoman and mother of the two brothers. She holds 21.62% of Cosmax BTI. Depending on whom she decides to support, the balance of power could still shift dramatically.

Ultimately, business performance has become critical once again. Lee Byung-man plans to further strengthen Cosmax’s core overseas businesses. Once the new Shanghai headquarters is completed, he aims to activate the related organization and increase Cosmax’s client base in China from 1,100 companies, targeting a “second leap forward.”

Meanwhile, Lee Byung-joo is collaborating with Heo Min-ho, Vice Chairman of Cosmax BTI and a former distribution expert from CJ Group. Together, they intend to enhance the control tower system, enabling six domestic and overseas subsidiaries to communicate in real-time and better respond to global clients.

A Cosmax Group representative commented, “The new CEOs have contributed to the growth of the group’s core businesses based on their expertise,” adding, “Combined with both the existing leadership and external appointees, we anticipate new synergies that will further globalize K-Beauty and drive the group’s growth.”

Kim Nayoung, Korea Finacial Times (steaming@fntimes.com)

[관련기사]

- Localization in Full Swing... Why Kolmar Korea and COSMAX Are Smiling Despite U.S. Tariff Bomb

- Pharmaceutical DNA in Kolmar Korea and COSMAX... True Commitment to R&D

- Trump’s Wavering Tariffs... Korean Food and Beauty Industries in Deep Concern Over Countermeasures

- “K-beauty” led by Cosmax · Kolmar Korea tops US imported cosmetics market, surpassing France ”

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![용산구 ‘나인원한남’ 88평, 9억 상승한 167억원에 거래 [일일 아파트 신고가]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025071010042800278b372994c952115218260.jpg&nmt=18)

![한국 경제 돌파구 ‘결정적 시기’ 금융 선순환 가속·AI혁신 대응 [병오년을 열며]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010400055108216dd55077bc2118218214118.jpg&nmt=18)

![전광우 초대 금융위원장 “AI혁명 산업 대변혁기, '적극적 금융' 역할 중요” [2026 신년 인터뷰]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010400012607134dd55077bc2118218214118.jpg&nmt=18)

![용산 ‘한가람’ 25평, 9.6억 내린 16.2억원에 거래 [이 주의 하락아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2023031509425002992b372994c951191922428.jpg&nmt=18)

![용산 ‘한가람’ 25평, 9.6억 내린 16.2억원에 거래 [이 주의 하락아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2023031509425002992b372994c951191922428.jpg&nmt=18)