According to financial reports on the 16th, SK innovation and SK E&S will hold a board meeting on the 17th to discuss the merger.

The Enforcement Decree of the Capital Market Act specifies the merger value calculation method for mergers between listed and unlisted companies. For unlisted companies (SK E&S), the merger price is calculated as the arithmetic average of asset value (1x) + earnings value (1.5x). For listed companies (SK innovation), the ransom price is calculated by averaging the closing prices of the last one day to one month. However, if the reference stock price is lower than the asset value, the merger price can be calculated using the asset value.

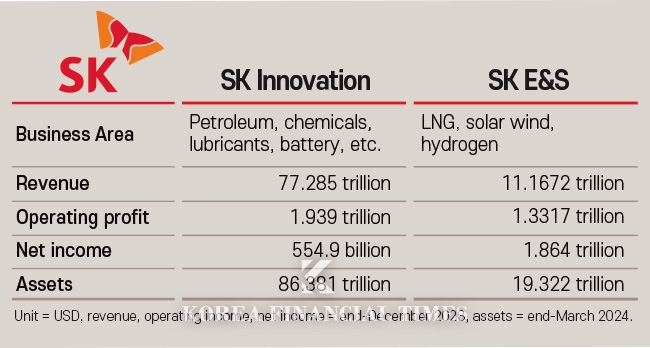

SK E&S is overvalued, while SK innovation is undervalued. Compared to SK E&S, SK Innovation has seven times the sales and assets, but its recent profits are similar. Moreover, SK Innovation's price-to-earnings ratio (PBR) is 0.5x, which is half of the average for KOSPI companies, due to a decline in its stock price due to the sluggish industry.

In conclusion, SK E&S shareholders are favored if the merger ratio is calculated based on stock price, while SK Innovation shareholders are favored if it is evaluated based on asset value under the exception rule.

The industry is expected to discuss the merger ratio based on stock prices. In this case, it is estimated that the merger ratio between SK innovation and SK E&S will be 1:2.

The largest shareholder of both companies is SK Corporation. It owns 36% of SK innovation and 90% of SK E&S. The higher the valuation of SK E&S, the lower the diluted share value after the merger. Convincing private equity firm KKR, which holds redeemable convertible preference shares (RCPS) in SK E&S, is also inevitable. KKR holds 3.1 trillion won worth of SK E&S RCPS. If the merger proceeds by increasing the valuation of SK innovation and KKR opposes the merger, it will have to repay the funds.

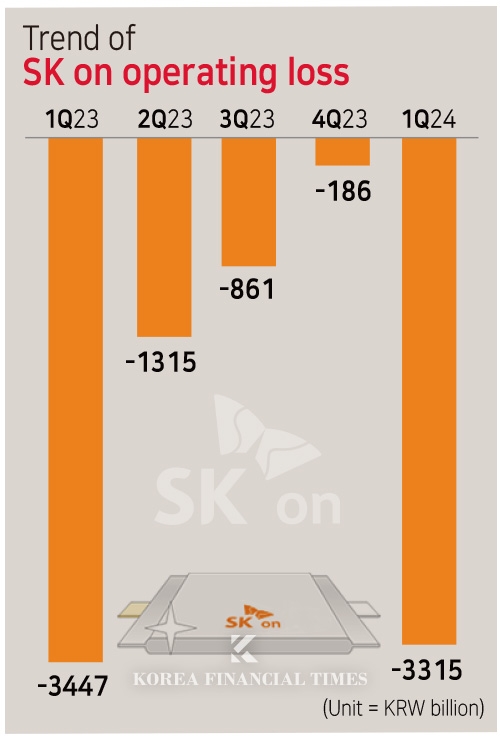

Analysts say the merger is focused on reviving SK Innovation's battery subsidiary, SK on. Since its launch in 2021, the company has lost money for 10 consecutive quarters until the first quarter of this year. A rebound in the electric vehicle industry in the second half of this year is uncertain. SK innovation has been raising trillions of won through capital increase, pre-IPO, and the issuance of subordinated bonds to build new batteries, but its borrowing capacity has reached its limit. The company raised another 500 billion won through a perpetual bond issue at the end of last month.

If SK E&S, a cash-generative company, were to merge with its parent company, SK Innovation, it could provide more support for SK Energy.

Of course, this is not a fundamental solution to SK E&S's funding crisis, so it needs to secure its own profitability. SK innovation had previously proposed a merger of its lubricant subsidiary SK Enmove and SK On, but it was reportedly canceled due to stakeholder opposition. More recently, SK Innovation has also been considering a merger with SK Trading International and SK Enterm.

SK innovation said, "We are reviewing various strategic measures to strengthen the competitiveness of the SK ON business, but no specific decisions have been made."

Gwak Horyung (horr@fntimes.com)

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![이재용 회장 ‘삼성의 미래ʼ PICK “올해 일 낸다” [K-휴머노이드 대전] ② 휴머노이드 원조 레인보우로보틱스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022214532407407dd55077bc221924192196.jpg&nmt=18)

![[속보] KAI 노조 "오늘 사장추천위 열린다"...사측 "확인 못해"](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=20260227135534054450d260cda7511817679169.jpg&nmt=18)

![이재용 회장 ‘삼성의 미래ʼ PICK “올해 일 낸다” [K-휴머노이드 대전] ② 휴머노이드 원조 레인보우로보틱스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022214532407407dd55077bc221924192196.jpg&nmt=18)