이미지 확대보기

이미지 확대보기On the 30th, E-Mart announced that it would tender 2.12 million 661,000 common shares (27.33%) of Shinsegae E&C's registered shares. Currently, E-Mart holds 5.46 million shares (70.46%) of Shinsegae E&C. It plans to buy all shares except treasury shares (171,432 shares, 2.21%) and then delist Shinsegae E&C.

이미지 확대보기

이미지 확대보기The tender offer price is KRW 18,300, which is 14% higher than the closing price (KRW 16,050) on the 27th. The total tender offer price is approximately KRW 38.81 billion.

Shinsegae E&C a group 'risk'...E-Mart 'bargain-basement' eyes

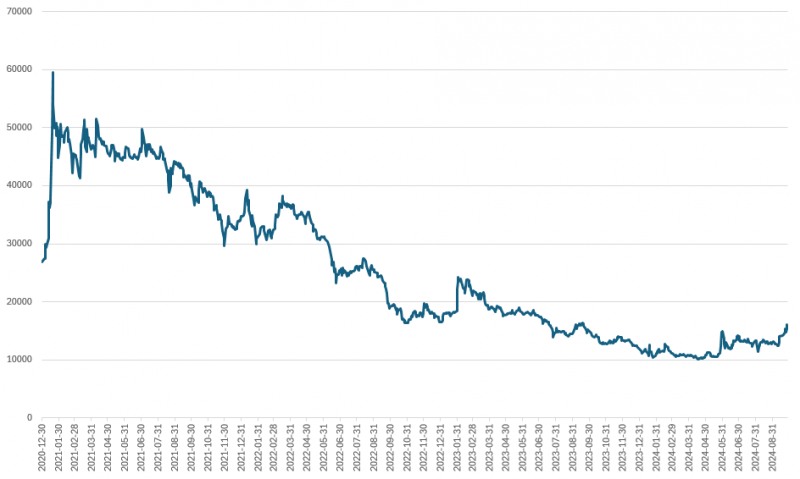

The purpose of E-Mart's tender offer is to simplify its governance structure and establish an efficient decision-making system. In the process, it emphasized the practice of responsible management and protecting investors holding shares of Shinsegae E&C.However, shareholders of Shinsegae E&C are not happy. Shinsegae E&C's stock price has been declining since 2021. With full group support expected, it is inevitable that E-Mart is seen as buying at a low price. It is inevitable that E-Mart will be criticized for buying at a low price.

The group's support for Shinsegae E&C began in earnest this year. In January, Shinsegae E&C merged with Shinsegae Yeongrangho Resort and secured KRW 68.6 billion in capital. In May, it issued KRW 650 billion in new capital securities backed by credit enhancements, such as the fund replenishment agreement from parent company E-Mart. And in June, the company transferred its leisure business to Chosun Hotel & Resort and received KRW 181.8 billion in proceeds. In addition, Shinsegae I&C purchased bonds (KRW 60 billion) issued by Shinsegae E&C to ease the repayment burden.

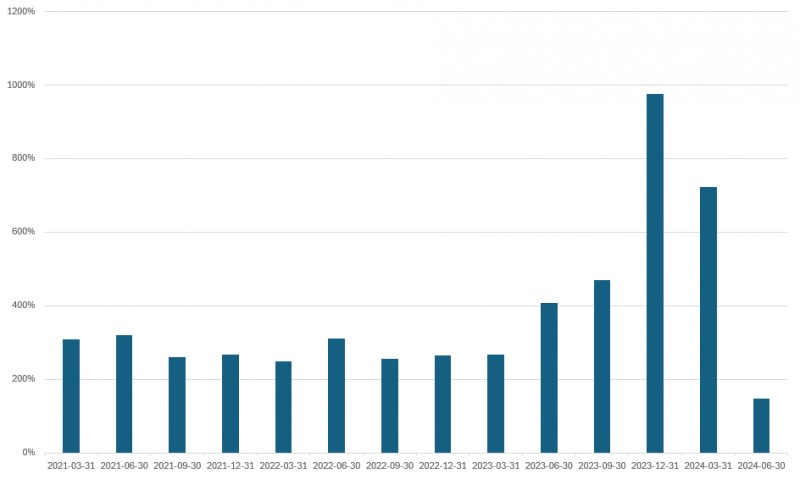

As a result of the diversionary support to E-Mart and its affiliates, Shinsegae E&C's debt-to-equity ratio fell from 976.2% at the end of last year to 145.7% at the end of the first half of this year. While improving profitability remains a challenge, the company's financial buffer has reduced the likelihood of a further downgrade following the downgrade earlier this year ('A0, negative' → 'A-, stable'). From E-Mart's point of view, Shinsegae E&C has less credit risk.

이미지 확대보기

이미지 확대보기Starfield has received relatively positive reviews among the projects promoted by Chairman Chung Yong-jin. Shareholders of Shinsegae E&C had high hopes that the company would be able to withstand the share price decline and rise again in a difficult environment, but E-Mart's tender offer will dash those hopes.

Shinsegae Star REITs launches, more disappointment for Shinsegae E&C shareholders

Shinsegae Property Investment Management, a subsidiary of Shinsegae Properties, will apply for a business license for 'Shinsegae Star REITs' next month, with Starfield Hanam as the underlying asset. Shinsegae Star REITs will purchase the 51% stake in Starfield Hanam held by Shinsegae Properties, and Shinsegae Properties will receive the proceeds from the sale.Shinsegae Properties will use a portion of the proceeds to secure a stake in Shinsegae Star REITs (50%). After the REITs business license is approved, the company will go public next year.

Shinsegae Properties is focusing on the development of new Starfield complexes. As the business requires large-scale expenditures, it plans to liquidate assets and secure investor funds through the REITs.

In this process, Shinsegae E&C will benefit alongside Shinsegae Properties. If Shinsegae Properties can stabilize its financing and improve its profitability, it will be positive for E-Mart, which will acquire an additional stake in Shinsegae E&C.

Group growth centered on Shinsegae Properties is not guaranteed. However, it is good to see that the financial buffer has reduced the difficulty of financing due to the group's creditworthiness.

“E-Mart's purchase of a stake in Shinsegae E&C is unlikely to have a significant impact on immediate credit fluctuations,” said a researcher at the rating agency. ”While Shinsegae E&C's actual borrowing burden has increased, its lower debt-to-equity ratio more than offsets this and demonstrates its willingness to support the group centered on E-Mart.” “If the securitization through Shinsegae Star REITs is followed by a successful IPO, the financial structure could improve more than expected,” he added.

Lee Sungkyu (lsk0603@fntimes.com)

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![IB '신흥강자' 키움증권, 김영국·구성민 전면 배치 [빅10 증권사 IB 人사이드 ④]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026020100281000034dd55077bc211821821443.jpg&nmt=18)

![강진두號 KB증권 IB 출범…주태영·안석철 배치 '2.0' 개막 [빅10 증권사 IB 人사이드 ③]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012509581004894dd55077bc25812315153.jpg&nmt=18)

![한투증권 IB그룹장 재건…‘전략통' 김광옥 부사장 복귀 [빅10 증권사 IB 人사이드 (2)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026011801440707653dd55077bc25812315214.jpg&nmt=18)

![미래에셋증권 IB사령탑 강성범…양날개는 성주완·김정수 [빅10 증권사 IB 人사이드 ①]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026011117585504903dd55077bc2118218214112.jpg&nmt=18)

![미래에셋운용 “코스닥 이익개선 동반 기대…'업종 쏠림' 전략적 활용 가능” [ETF 통신]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260202144658039670f4390e77d222110701.jpg&nmt=18)

![배형근號 현대차증권, 리테일·IB 수익 증가로 실적 개선…퇴직연금 성장세 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025012311570804055179ad439072115218260.jpg&nmt=18)

![빗썸, IPO 추진 동력 지속…체질 개선 총력 [가상자산 거래소 지각변동 ④]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026020100324904384dd55077bc211821821443.jpg&nmt=18)

![기관 '한미반도체'·외인 'NAVER'·개인 '삼성전자' 1위 [주간 코스피 순매수- 2026년 1월26일~1월30일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026013022473402636179ad439071182357237.jpg&nmt=18)

![기관 '에코프로'·외인 '에코프로'·개인 '알지노믹스' 1위 [주간 코스닥 순매수- 2026년 1월26일~1월30일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026013022563407542179ad439071182357237.jpg&nmt=18)

![빗썸, IPO 추진 동력 지속…체질 개선 총력 [가상자산 거래소 지각변동 ④]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026020100324904384dd55077bc211821821443.jpg&nmt=18)

![IB '신흥강자' 키움증권, 김영국·구성민 전면 배치 [빅10 증권사 IB 人사이드 ④]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026020100281000034dd55077bc211821821443.jpg&nmt=18)